Motorcycle Investor mag

Subscribe to our free email news

Boom or Bust?

Part 1 – July 20, 2020

We’re running a two-part series speculating on the mid-range future of the classic motorcycles market.

Central to this is the question of whether the rise in values across recent years is a phenomenon that lives and dies with baby boomers.

The first piece is by Phillip White (pictured below) , who was a little concerned that we expressed an interest in running it, with the advice it might be too gloomy.

Nevertheless, we thought it was worth giving a gallop.

See part 2 here. It looks at a similar issue, but from a different angle.

Value Judgement

by Phillip White

This article is several years old and has acquired not one but two post scripts to contemporise the content. I trust readers will tolerate that the narrative wanders a little as new events and opinions are woven in. My qualifications are as one who has spent an enormous amount of time and money over the years on cheap bikes.

Howdy Classic Fans. The title of this essay is actually a bit of psycobabble from the Eighties, nonetheless it handily introduces a subject that often appears in classic bike magazines concerning the ebb and flow of values in the classic scene. It is generally accepted that when men (and lets face it, this applies pretty much only to the male of the species) hits the 45 to 55 age bracket they have the desire and wherewithal to finally buy the machines they could never afford as young blokes.

This moveable wave of newly minted grey beards drives up prices for collectable machinery. However, when the wave passes then the value of said machines can recede like the outgoing tide. Aside from men trying to repurchase their youth there are other economic forces at work that are worth considering, particularly in regard to old motorbikes as investment vehicles.

It is extremely difficult to analyse precisely the forces that shape any one transaction but it seems to me that the Classic scene is fragmenting along wealth and age lines. At the top end we have the emergence of that hhich I term the Glass Case Motorcycle bikes like Brough Superiors and Vincents have appreciated hugely. These machines and others of their ilk are no longer merely motorcycles as we would understand the term but have taken on the aspect of both objet d’art and investment vehicles.

Recently a Vincent White Shadow sold for well north of a quarter of a million dollars of course the Black Lightning formerly owned by Jack Ehrett Hit the million dollar mark. In the UK, the collapsed piles of ferrous oxide that were the Bodmin Moor Broughs went for astounding amounts. I doubt if we will ever see any of these bikes chucking doughnuts at the All Brit Rally.

What is driving this? Well for a start there is more paper wealth in the world. To understand this phenomenon we need to visit the dismal science, as economics has been called. When the last huge asset bubble burst and heralded in the GFC, all governments reacted exactly as the great depression era economist John Maynard Keynes said they should. That is, print more money to prevent solvent and profitable enterprises being destroyed along with the over leveraged speculators who needed to go. However it has never been proven that Mr Keyne’ theories worked. When put into practise in the great Depression, the dire economic situation seemed to improve for a few years, then in 1937 world economies tanked again, it was only the arrival of World War II that finally brought the dirty thirties to an end.

When too much of a product is produced the price goes down, in this case the oversupplied product is all that money that various electronic printing presses have flooded the world with. Money has lost so much value that German banks actually charge negative interest on deposits. That is, they will take your million bucks, but will charge you a storage fee. At the moment we in Australia have very low interest rates and they may fall further. This is not necessarily a good thing, as it shows a weak economy.

Japan has been in an economic coma for more than two decades because it did not let insolvent companies and banks perish. Returns on real investments are low and investors seem to be buying things like art, real estate and classic vehicles based on what is termed The Greater Fool theory. This occurs when the investment vehicle has been disassociated from economic realities and is simply blue-skying up, driven by cheap money and low returns elsewhere. The theory being that the next buyer will pay more than you did because the asset is rising in price.

Is this a bubble? Will it burst? Well, of course it will, as bubbles always do. Remember when the Japanese were buying everything in sight? That was made possible by hugely inflated real estate prices. Well get ready, the Chinese real estate bubble is far, far bigger than the Japanese one ever was, watch this space. Markets like this are also very vulnerable to manipulation. For example, certain unscrupulous art dealers have been known to tout a particular artist (usually recently and safely dead) and steadily raise the price by ‘selling’ to each other. Eventually the promoters take their profits and the art work declines back towards a more realistic value.

This scam happens with stocks as well, By the time you get to hear about a hot stock tip, if you can’t figure out who the sucker is — it’s you. Could this manipulation of values happen In the world of classic bikes and of course, classic cars? If the purchaser at a high-end auction is investing for a return it is a question worth reflecting on.

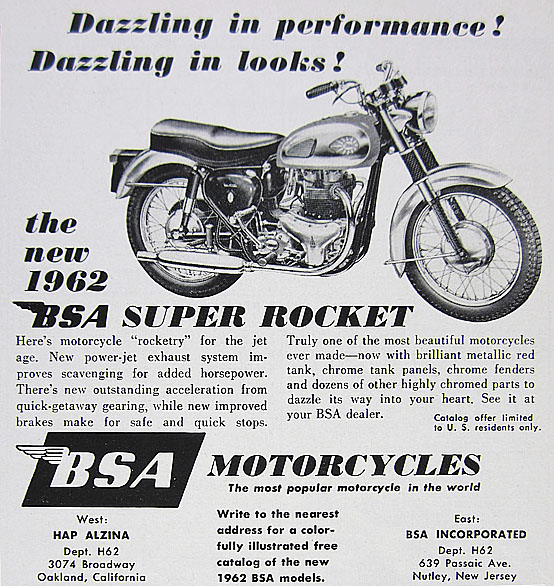

At the other end of the spectrum, where I live, the humble but excellent BSA A10 hovers around the 10 to 14 grand mark for a nice one and prices seem to be heading South. Remember that scene from the movie The Castle where this young fellow says, regarding his father’s poorly-located house: ”It’s worth nearly what he paid for It!” I got $16,000 for an A10 six years ago, but the price would be lower today. That represents a steady decline in value relative to the broader economy. Why? They are, in my opinion, about the best product that the British motorcycle industry produced, a real rider’s machine. And that’s the problem, we have less and less real riders for this vintage of bike.

Not surprisingly, there is an increasing number of ageing boomers who either think they still ride, but are in fact past it or alternatively ride something with the three Es: electric, easy and economical. They still own their classics of course, therefore they don’t need to buy any more old bikes.

The centre of gravity of the classic scene will continue to shift towards younger enthusiasts to whom a 50s Brit Bike has little relevance. It is noticeable that when perusing the stock lists of classic dealers there is an increasing swing towards 70s and 80s oriental machines. The upshot is that bikes like the rather excellent Suzuki Titan are on a roll but I doubt that run-of-the-mill Pommy stuff will outstrip such inflation any time soon.

There is one more recent event that is impacting the local market for classic bikes. A decade back when our dollar reached and then exceeded parity with the US dollar then everybody and his mate, and his mate’s mate started importing classic everything. This oversupply has impacted significantly on prices and has yet to be worked out in the market place.

Let’s use older Indians as an example. Although there is wildly expensive and collectable Indian exotica such as 8-valve board trackers that still bring the big bucks, normal post-war Indians seem to be falling.

There was a time when Black Hawks were a bit rare, and I might have achieved the $60,000 mark for my late Springfield Chief but now I would be lucky to see $ 50,000, if that. The stock-in-trade 1946 to 1948 bikes are sub-30k for a rough one and something with a four in front of it will buy a nicely restored one.

Indian fours are not the flavour of the month any more. They were selling around the 120 grand mark a few years back but 90 grand should do it.

I also think people are losing interest a little in twinkly restorations, it used to take a lot of work and many contacts to restore an old bike, now all it takes is a big wallet and internet access. The hot item now is unrestored machines with a nice patina.

So how does a collection of obsolete motorcycles stack up as an investment? Not too well, I would suggest. The exception to this of course would be if you were astute enough to buy what are now very collectable bikes such a four-cylinder American Bikes or Broughs many decades ago. You would have had to pay relatively big prices even 30 or 40 years ago but by now time would have worked its magic and you could now cash them in.

Here’s a good example of how things are not always as straight-forward as they appear. Some 400 years ago the Dutch traded 24 boxes of assorted goods with the local Indians for the island of Manhattan. A poor trade? Maybe even a rip-off? If the Indians had invested well the value of those goods and let the returns compound, the portfolio could be worth more than all of New York City today.

This fascinating hobby of ours is a labour of love and I don’t regard my motley collection of classic bikes as a financial asset. After all I can’t guarantee what they will be worth when I put the metaphorical side stand down for the last time. But by the same token one should not fall into the trap of knowing the price of everything and the value of nothing, Rideable old bikes are a grand passion but a poor investment.

Now as regards rideabilty, Indians are a special case because the because not only can they mix it with modern traffic they are also supremely comfortable to ride. I rode my Black Hawk from Perth to Melbourne in the same time as it would legally take on a modern and probably in greater comfort. Few old bikes can make that claim.

I have ridden a Brough Superior and it was awful. I reckon Lawrence of Arabia must have had balls the size of mangoes to punt one of these things along at speed. Ditto the Vincent, fun to ride, but not far. (Of course, this is just my opinion, others are available.)

Is there a moral to this story? I think so. Many old bike nuts see their collection of obsolete vehicles as an asset so lets check the accepted definitions.

1. Asset: Something that puts money in your pocket, for example shares;

2. Security: Something that can be borrowed against, for example your house. Your house only becomes an asset if you move out and the rental income is exceeds the cost of servicing any debt that the property may carry;

3. Liability: Something that takes money out of your pocket. That is old bikes.

Does any of this financial stuff matter? Well, not to me. Whatever my bikes have cost me I can’t put a price on the sheer fun of owning, fixing and riding them. It suits me if the prices of the bikes I like steadily decline in real terms. To me modern bikes are soul-less appliances and of little interest. As a good biking buddy of mine in Europe says, “If you want a vanilla experience, ride a vanilla motorcycle.”

On the other hand if you truly regard your bike collection as a financial hedge against the future, start selling now and avoid the rush!

POST SCRIPT

This article was written several years ago. It is worth noting that in this time period Australia's financial position has declined a little more, interest rates have indeed dropped further and Japan has again slipped back into recession. Anecdotally I am hearing that other old bike sellers are having problems finding old bike buyers. Anything under ten grand is selling but above that it is a bit of a struggle. Another problem is that as this is an age-related hobby and an increasing number of collectors are dying.

Recently 1200 mostly British motorcycles have hit the Australian market from a single deceased estate. That’s going to take some absorbing.

I understand from people in the industry that there are two further lots of 600 bikes each that are also close to being marketed.

And of course, we must realise that the petroleum era is drawing to a close. Generally speaking most up and coming young urbanites have a very different relationship with motor vehicles than we experienced and in many cases are happy to be car-free.

I should point out that predictions concerning the future are more often than not, wrong. One wild card is that people are living longer. Remember if you were a kid back in the 50s and somebody’s grand-dad died, the old chap was probably 63 and that was considered a fair innings.

It’s likely we boomers will be around much longer so here’s to many more rides and restorations!

POST POST SRIPT

In revising and updating this article for further publication It is necessary consider the impact of Covid 19 what the post-Covid world look like.

There is much to consider: There is an old Chinese curse that says “May you live in interesting times” We certainly are experiencing that. It is to be hoped that the post-Covid era will be one of recovery and returning prosperity however there are gale force head winds to face. It has been pointed out by historians and analysts that there are eerie echoes of the late nineteen thirties in current times: such as the rise of Demagogues on the world stage and the instability of international relations.

There also exists the very real possibility, in Australia and other developed economies, of massive fiscal problems as many consumers at all levels of the population default on mortgages, car loans and credit cards when stimulus (read fake money) is perforce withdrawn.

In Conclusion: We have entered uncharted waters. Collecting, fixing and riding old bikes for fun and camaraderie will continue, I am sure. However if you are an investor, old bikes may or may not prove to be an ark to transfer wealth across troubled waters, time will tell.

-------------------------------------------------

Produced by AllMoto abn 61 400 694 722

Privacy: we do not collect cookies or any other data.

Archives

Contact